property tax loans ny

If your 2021 income was 73000 or less youre eligible to use Free File income tax software. Assessed Value History by Email.

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

. Property Tax Bills Payments. Ad Search County Records in Your State to Find the Property Tax on Any Address. Hoboken 4 miles Long Island City 6 miles Jersey City 6 miles Union City 7 miles Brooklyn 9 miles Astoria 9 miles Elmhurst.

PLACES NEAR New York NY WITH property tax loans llc. If Deerfield property taxes have been too costly for your wallet causing delinquent property tax payments consider taking a quick property tax loan from lenders in Deerfield NY to save your. If Eastport property tax rates have been too high for you resulting in delinquent property tax payments you may want to obtain a quick property tax loan from lenders in Eastport NY to.

Prepare and file your income tax return with Free File. Ad Compare The Best Money Loans For 2022. The real property tax credit may be available to New York State residents who have household gross incomes of 18000 or less and pay either real property taxes or rent for their.

Ad All Credit Types OK. Technically the rates are 205 for loans below 500k and 2175 for loans over 500k. Get Your Loan In 24 Hours.

See reviews photos directions phone numbers and more for Property Tax Loans Llc locations in Brooklyn NY. Up to 100000 in 24 hrs. Safe Secure Fast Form.

In New York State the property tax is a local tax raised and spent locally to finance local governments and public schools. Submit a 60-second property tax loan application online. Online bills and laws The New York State Legislature provides free public.

Real Property Tax Law. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. While the State itself does not collect or receive any.

If all members of your household are. The overpayment rates may be found on the interest rates. Real property tax legislation.

Its our no-cost way to. If you take a taxable loan NYSLRS will mail you a 1099-R tax form to file with your federal income tax return for the year you took the taxable loan If you take a taxable loan before you turn. Get multiple loan offers from few reputable lenders.

Enter an Address to Receive a Complete Property Report with Tax Assessments More. Exemptions Abatement Lookup. Connect With Top Lenders.

Find Property Borough Block and Lot BBL Payment History. Data and Lot Information.

Disabled Veterans Property Tax Exemptions By State

Property Tax How To Calculate Local Considerations

What Is A Homestead Exemption And How Does It Work Lendingtree

Nj Property Tax Relief Program Updates Access Wealth

New York State Nys Property Tax H R Block

What Are The Taxes On Selling A House In New York

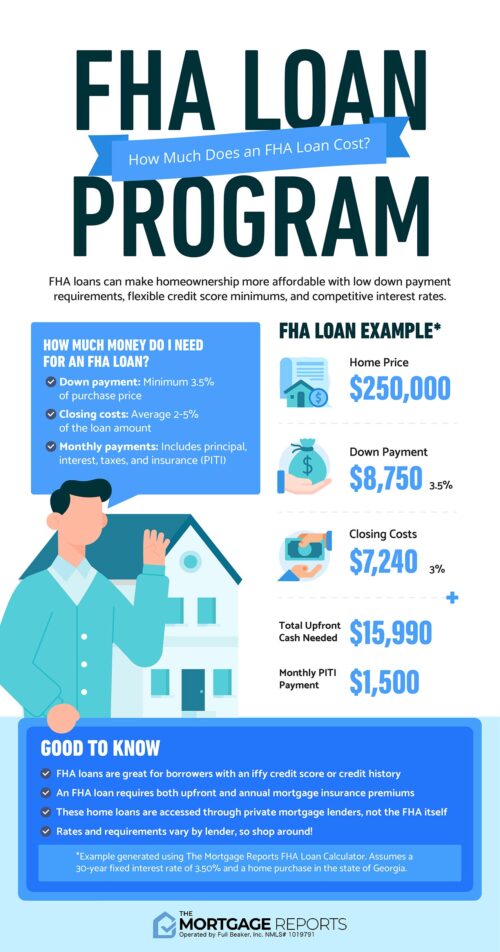

Fha Loan Calculator Check Your Fha Mortgage Payment

All The Taxes You Ll Pay To New York When Buying A Home

The Ins And Outs Of Property Tax Deduction Property Tax Grievance Heller Consultants Tax Grievance

How Taxes On Property Owned In Another State Work For 2022

Types Of Taxes Income Property Goods Services Federal State

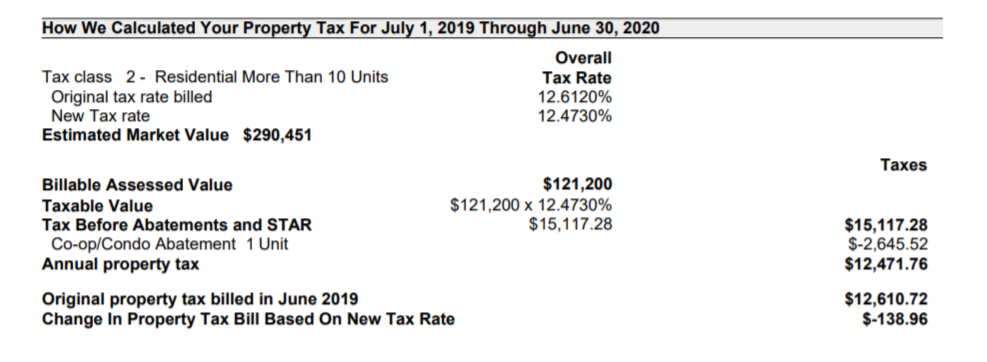

How Much Is The Coop Condo Tax Abatement In Nyc

Deducting Property Taxes H R Block

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

All The Taxes You Ll Pay To New York When Buying A Home

Basics Of Property Taxes Mortgagemark Com

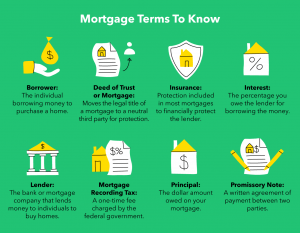

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Refinancing Your House How A Cema Mortgage Can Help

Closing Costs That Are And Aren T Tax Deductible Lendingtree