how to file back taxes yourself

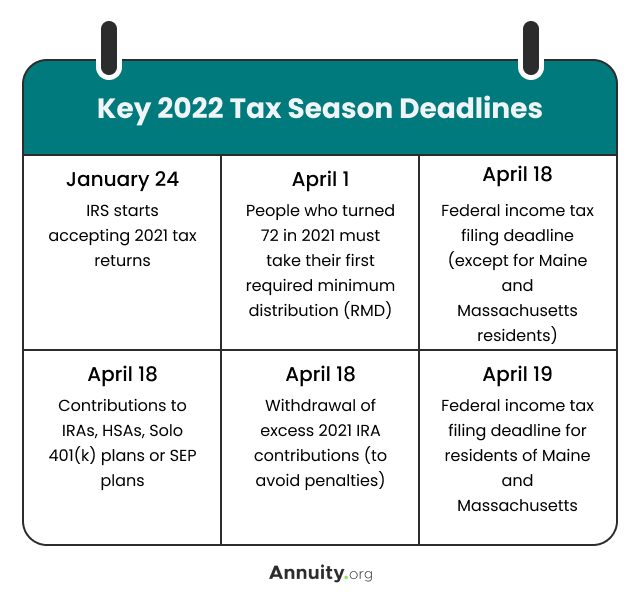

Since tax laws change year. Remember you can file back taxes with the IRS at any time but if you want to claim.

How To File Taxes For Free In 2022 Money

Not filing a required return is a serious issue with the IRS.

. Settle Tax Debts up to 95 Less. Other earning and interest statements 1099 and 1099-INT forms Receipts for. Back tax returns at a glance.

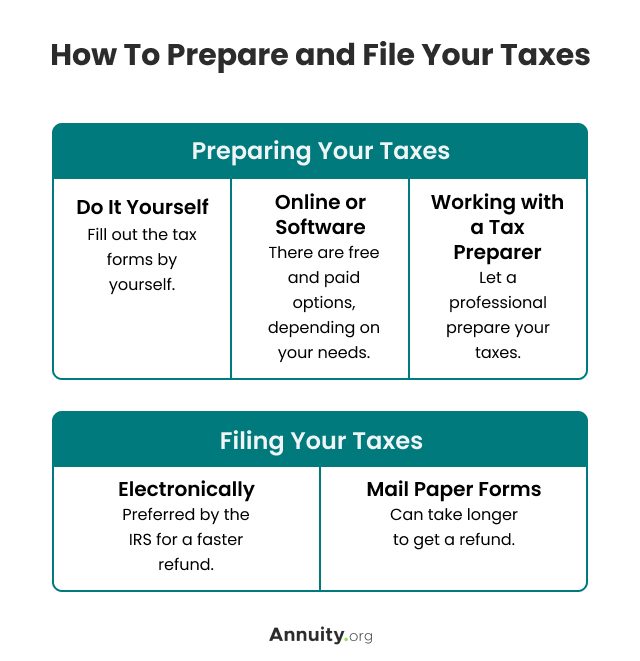

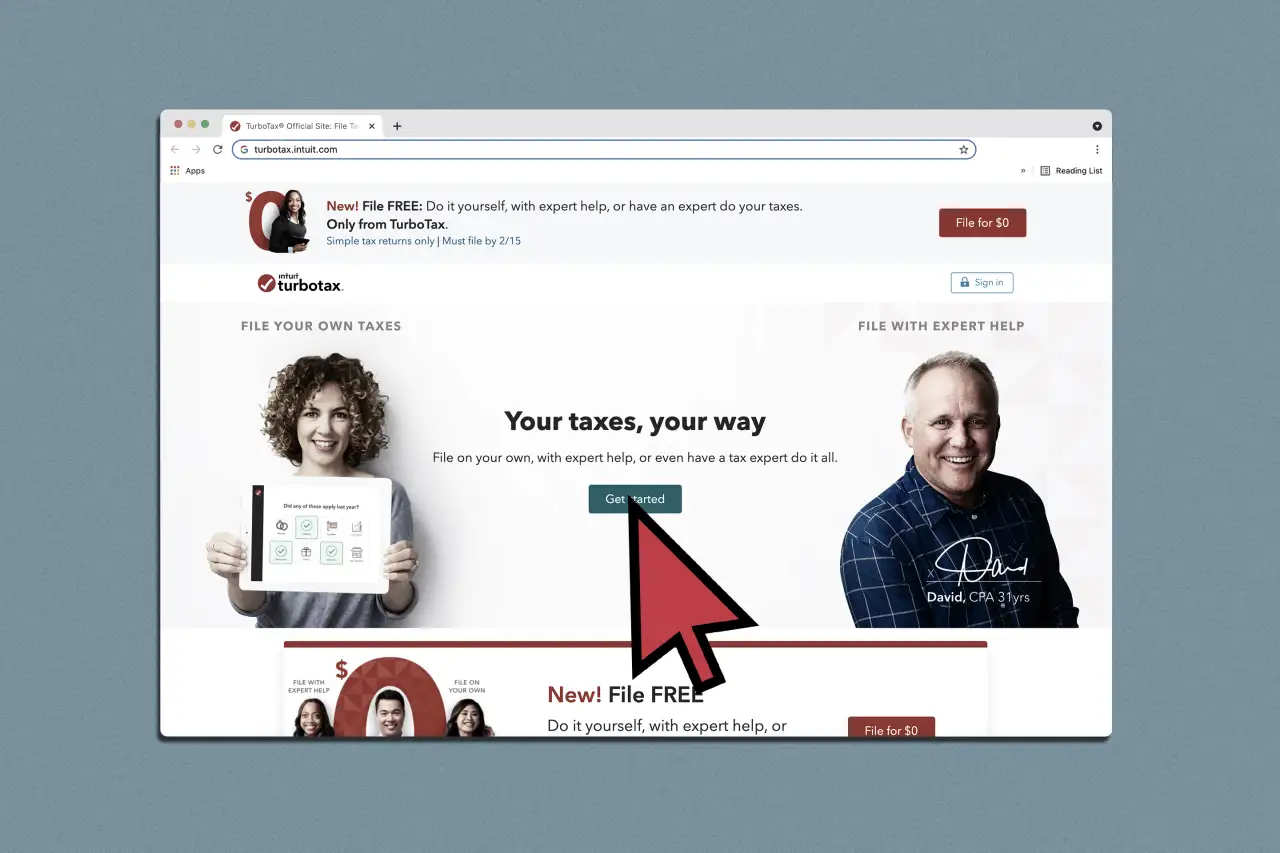

End Your IRS Tax Problems - Free Consult. In the event that you or your life partner has not gotten a W-2 structure by January 31 call the business and request another duplicate. The software tells you whether itemizing your deductions or claiming the standard deduction will save you the most money taking the guesswork out of this process.

Companies that paid at least 1500 in wages or had at least one employee work part of a day in at least 20 different weeks of the year are required to file the form. Gather your paperwork including. Even though you are filing late you are.

It will make your life easier during tax season. Protect Your Social Security Payments. Steps to File a Tax Return.

Ad You Can Still File Tax Returns For Past Years. Then youll have space to correct any errors on your original tax return. End Your IRS Tax Problems Today.

If you need wage and income information to help prepare a past due return complete Form 4506-T. Free Federal 1799 State. Ad Save Money from IRS Tax Penalties With the Best Tax Relief Services.

Ad BBB Accredited A Rating. If you want to tackle filing your back taxes by yourself choose a reputable tax software company to assist you. Make sure you actually have to pay.

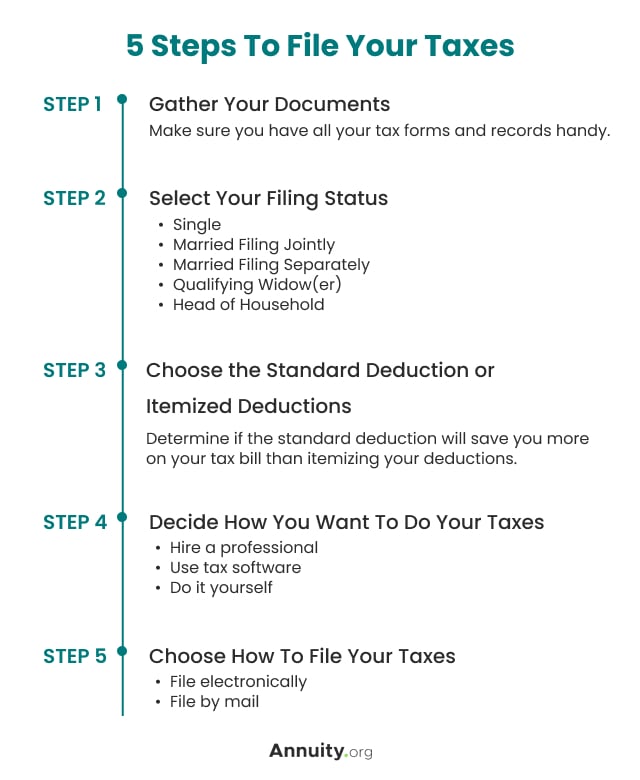

Step 1 Get your wage and income transcripts from the IRS. Collect Your Paperwork. TABLE OF CONTENTS.

Before you file back taxes make sure you have all the relevant tax forms for that tax year. For example you should subtract household expenses from your total income. 1 PDF editor e-sign platform data collection form builder solution in a single app.

First you need to gather your tax documents from the missing year s including. You Can Still File Tax Returns for Past Years. You should take special.

Honest Trusted Reliable Tax Services. To file back taxes youll need to purchase the edition of HR Blocks software. Obtain proper tax forms.

Estimate how much you owe. Get Your Max Refund Today. Free Federal only 1799 State.

Figure out how much you earned. First complete the necessary information including your name address filing status and more. It takes about six weeks for the IRS to process accurately completed back tax returns.

Tax Relief for IRS Tax and State Tax. You file past due returns in the same manner that you would file a return that is on time. Compare 2022s 10 Best Tax Relief Companies.

Simply follow the steps below. However there are many. Attach a statement that includes the form number of the return youre filing the tax year the reason your spouse cannot sign the return and that your spouse has agreed to your.

Add up your business expenses. Ad Download Or Email NJ-1040x More Fillable Forms Register and Subscribe Now. Bear in mind that even with an agreed-upon.

Fast And Simple Tax Filing. For filing help call 1-800-829-1040 or 1-800-829-4059 for TTYTDD. Get Your Taxes Done Right Anytime From Anywhere.

A wage and income transcript shows data. Stay on top of tax-related paperwork throughout the year. Save the right paperwork all year long.

Solicitation Replacement W-2. Back taxes are any taxes that you owe that remain unpaid after the year that they are due. Determine deductions to reduce taxable income.

Ad Worried About IRS Tax Issues. This form is an official request for a transcript of W-2s 1099s and 1098s issued in your name and Social Security number going as far back as 10 years. You may be tempted or receive advice to just file on your own online or visit a tax-preparer not specialized in late-filed returns and CRA encounters.

Gather the correct tax documents and other information. No unfortunately the HR Block Online program is only designed to be used for the current years returns. Collect W-2s 1099 tax forms and any other income or.

A W-2 form from each employer. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. If you do not need an attorney or CPA follow these steps to file your back tax returns.

End Your IRS Tax Problems - Free Consult. If you need supporting evidence for income earned and deductions file. If you dont file the IRS can file a return for you with taxes and penalties.

You might want to keep receipts for things like. Filing Back Taxes. Here are four common options that could help you find some relief plus guidance on how to file back taxes and how many years you can file back taxes for.

Ad Proven Solutions Many Helped. Ad BBB Accredited A Rating. Basically if you let an entire filing year go by without paying the IRS what you owe its.

Then cut a check for the difference to the IRS.

How To File Your Income Tax Return In Spain With Useful Tips

3 Ways To File Your Taxes For Free Forbes Advisor

How To File Taxes For Free Turbotax 2022 Free File Change Money

3 Ways To File Just State Taxes Wikihow

2022 Filing Taxes Guide Everything You Need To Know

File Your Own Taxes Online Turbotax Official

Unfiled Tax Return Information H R Block

Ways To File Taxes For Free With H R Block H R Block Newsroom

How To Get Maximum Tax Refund If You File Taxes Yourself

Filing Back Taxes What To Know Credit Karma Tax

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Tax Season 10 Tips For Doing Your Taxes Yourself

How To File An Extension For Taxes Form 4868 H R Block

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

2022 Filing Taxes Guide Everything You Need To Know

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

2022 Tax Day Filing For A Tax Extension Here S How That Works And When Your Taxes Are Due Nbc Chicago